Life insurance has been on your to-do list for years. You intended to knock him out, but . . . life happens. Well, here’s some good news: there’s one less obstacle between you and the blanket these days.

Over the past couple of years, some insurance companies have started offering a no-exam life insurance application option, and it doesn’t come with exorbitant premiums. If you’re under 65 and looking for a policy worth $2 million or less, you may be able to skip the lab work and apply without a medical exam.

This flexible new option means one less hoop you have to jump through on the path to peace and security for your loved ones. Here’s what you need to know to get life insurance without a medical exam.

Whole vs. Duration: Which life insurance without medical examination?

Before we look at the amount of coverage you can get or the cost, we need to talk about the differences between whole life insurance and term life insurance.

![]()

Compare term life insurance quotes

First, with or without a medical examination, term life is always better than a whole life insurance policy. Why? Because the only job of a life insurance policy is to replace lost income resulting from someone’s death. With term life, you put yourself and those you love in the perfect position, with the ability to replace your income should the unthinkable happen, all at a truly affordable price. As for whole life? It’s a big scam! It’s not only much more expensive than term cover, it also mixes with bad investment products with Life insurance, but ends up helping you with neither. Quite distinct from the question of medical examinations, avoid whole life insurance policies at all costs.

What is life insurance without a medical exam?

Let’s go back to the lack of a medical examination. It’s a way to buy a font that not require you to pass a medical examination to be covered. But the are certain conditions. In certain age groups, customers with purchase policies of $2 million or less can sometimes skip the exam altogether and still get the most competitive term life insurance rate available. As a rule, we are talking about healthy people. These policies are ideal if you want to get coverage as soon as possible.

But are you guaranteed not to undergo a medical examination if you meet the right criteria? Not necessarily. Even if you feel really healthy and are under 65, you will still have to answer questions about your medical history. and disclose any conditions you have on your term life insurance policy application.

Based on your answers, the insurance company will decide if you still need lab work or medical records to be approved for a policy. Honest and complete answers are a must because if they find out you hid something on your application and you end up dying, your death benefit will most likely be withheld for your beneficiaries. And . . . that’s the reason you get insurance in the first place, isn’t it? Honesty is the best policy, and it will help you get the to the right policy for you and your family.

Types of No Medical Exam Life Insurance

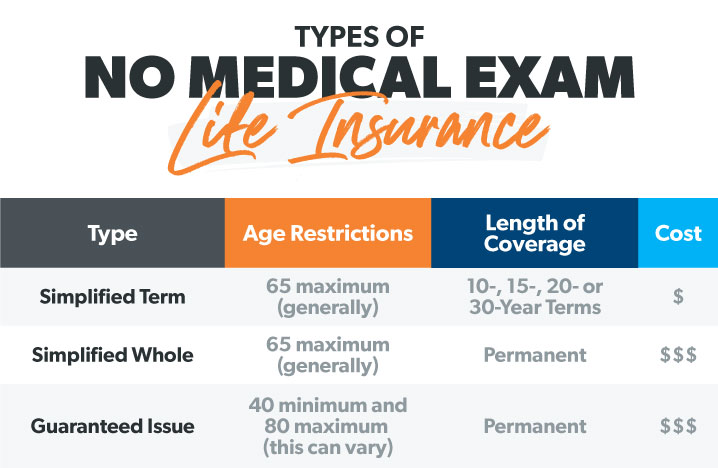

Does life insurance without medical examination seem rather interesting to you? Great! But which one is right for you? Let’s review the main types of life insurance coverage you can get without a medical exam.

Simplified term life without medical exam

It’s all in the name. These simplified term life insurance policies allow you to get term life insurance (the type of coverage we always recommend both for price and simplicity), but they do not do require a medical examination. It’s awesome! But even without the medical approach, these policies To do requiring applicants to answer a health questionnaire.

Simplified whole life without medical examination

Again, the name helps here: you can purchase this policy without a medical exam by completing a health questionnaire. But we do not recommend this type of coverage at all. Why not? Because whole life insurance is one of the dumbest financial products on the market! It mixes two important jobs – life insurance and investing – and gives you a horrible payoff in both departments. Don’t just skip the medical exam, completely skip this whole life.

Guaranteed issue

Guaranteed issue is another no-medical option, but the problem is that it’s also one of the most expensive ways to get life insurance. To get a guaranteed issue policy, you not only skip the medical exam, you also skip the health questionnaire!

But the market for this type of policy is quite limited. It is designed to help people who would otherwise be uninsurable. Beyond the high price, there are a few basic limits many companies place on this type of coverage:

- Minimum age: generally 40 years old

- Maximum age: generally 80 years old

- Coverage limits: typically $5,000 to $100,000

These aren’t hard and fast rules, but if you’re in that four-decade life window, a guaranteed problem might be within your grasp and a helpful option.

Now, there is another problem with this type of policy that you should know about. The guaranteed issue falls under what is called a graduated death benefit. What is it about? This means that if you are the policyholder and you die shortly after taking out the policy within three years (your beneficiaries), your beneficiaries will only get part of the full death benefit. But it’s life insurance coverage, and it’s the one with the least strings attached. If you’ve been turned down for other types of life insurance due to health issues, a guaranteed issue policy might provide you with enough coverage to meet your final expenses.

How does no medical exam life insurance work?

Remember when we mentioned the lower price of term life insurance as one of its main draws over whole life insurance? Perhaps you guess that by avoiding the usual medical examination, you will have to assume much higher premiums. But this is not necessarily the case.

If you opt for a no-medical term life insurance policy, the price should still be quite affordable – and it will definitely be better any rate you would get for a whole life insurance policy!

It’s also reasonable to wonder how these companies decide to cover people for life insurance without giving them the normal exam for height, weight, and other basic health measurements. Here is your answer: technology. Yeah! Using statistics and algorithms, these companies have found a way to offer the same competitive rates as used to require a review with one less hurdle to clear.

Who is entitled to life insurance without a medical exam?

If you fall into one of the categories below, you may be an ideal candidate for a no medical exam life insurance policy:

- People who are basically in fairly good health and don’t have an extensive medical history.

- Busy people who just want quick coverage but don’t want to mess with appointments and needles. (Reliable!)

- Young smokers who have no other medical conditions.

How much coverage can you get and how much does it cost?

If you qualify for life insurance without a medical exam, you can now get coverage for up to $2 million. That sounds like a lot – and it is. But you’ll need 10 to 12 times your annual salary in term life insurance to make sure your family can replace your income if something happens to you. So if you make more than $200,000 a year, you’ll need more coverage than a no-medical policy can provide.

No-medical life insurance used to be more expensive than traditional policies, but not anymore! These policies are now much the same as medically underwritten policies. The exact monthly payment you receive will vary depending on your age, medical history and other factors. Once you complete your application, the insurance company not only determines your insurability, but also how much they will charge you for your policy.

Should I take out life insurance without a medical exam?

The short answer? Yes, as long as you don’t need more than $2 million in coverage. If you meet the criteria of the insurance companies, no medical exam policy is great. They can save you time and the experience of a medical examination. Moreover, the cost is affordable. It’s a win-win-win.

Use a provider you can trust

Getting life insurance just got easier. Now you have one less excuse to move on and prepare your family for life should something ever happen to you. For a small amount of money per month, you can get coverage that will give you peace of mind knowing your family is protected. We recommend Ramsey’s trusted provider, Zander Insurance. Start your term life insurance policy today.

Comments

Post a Comment