- Get link

- X

- Other Apps

Featured Post

- Get link

- X

- Other Apps

From remembering enrollment dates for your region, to planning start dates, to missed deadline options, it can be hard to keep up. Worse still, the information you need is usually scattered across the internet.

But it is also a great opportunity to find the right mutual health insurance at the right price. It’s time to clarify some things.

We’ve included everything you need to know in one place, so you can bookmark and reference it anytime. We want you to feel confident about your 2022 health insurance decisions.

When is enrollment open for Health Insurance Coverage 2022?

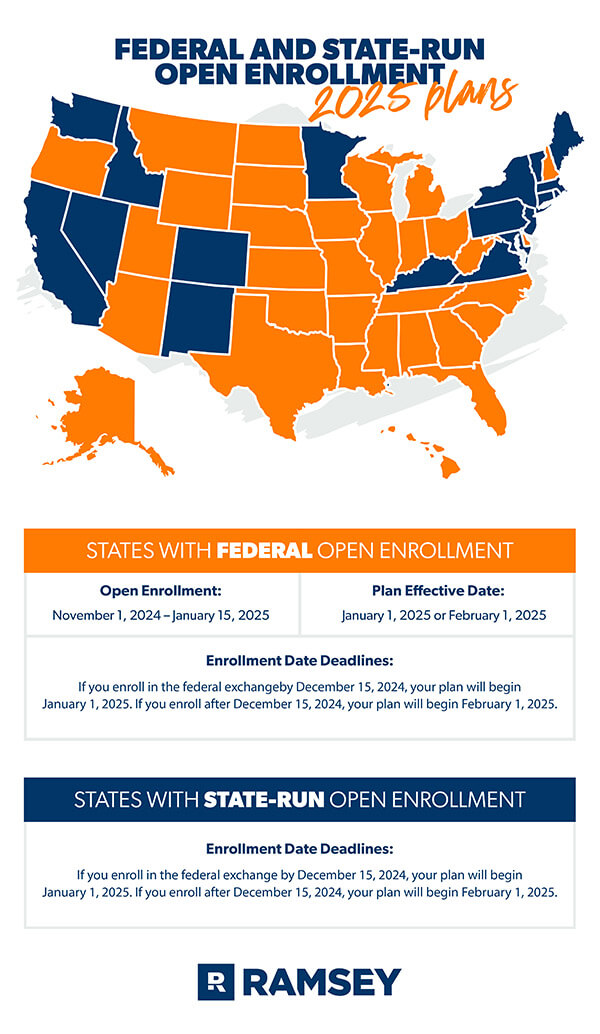

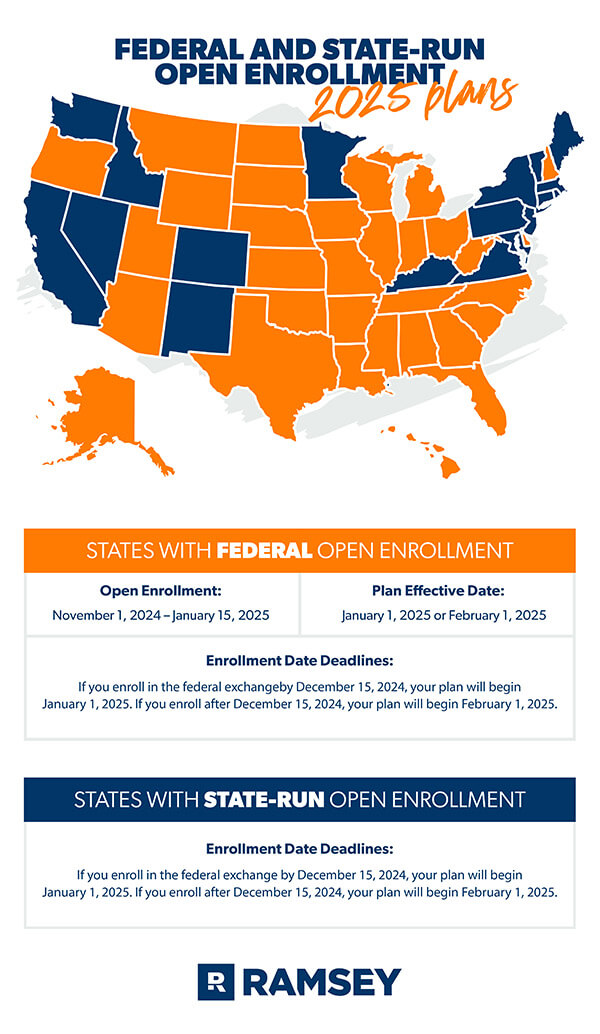

Before we dive into specific dates and timelines, you should know that most states use the federal marketplace (aka exchange), but there are currently 15 states that run their own health insurance exchanges.

First, let’s talk about the states that use the federal market. For 2022 health insurance coverage, the US government has extended the registration deadline from December 15, 2021 to January 15, 2022, giving you an additional month to register.

![]()

Do you have the right insurance coverage? You could save hundreds! Contact an insurance professional today!

Then, the 15 states that run their own health insurance exchanges have individual enrollment deadlines and plan start dates. Let’s look at these dates in detail as well as the states that use the federal market.

Dates and deadlines for health insurance coverage 2022

The graphs below show the plan’s open enrollment and effective dates for all 50 states.

If you’re still unsure of the effective date of your state-run exchange’s plan, Check with your state market for details.

What information do I need to enroll in a 2022 health plan?

Now that you know when you need to sign up, let’s review what you need to know before signing up.

Do not worry. You won’t have to learn anything complicated or dig up old documents. All you need to do is follow a few simple guidelines before signing up for a one-year commitment. Let’s break down each one.

Identification

You’ll need some basic personal information for everyone you want to include in your plan:

- Last name and first name

- E-mail address

- Date of Birth

- State of residence

- Social Security number

- Estimated income for the year you wish to be covered (include all household members even if they do not require health insurance)

Cost

Whether you’re signing up for a plan just for yourself or for your whole family, you’ll need to understand basic health insurance industry lingo so you can select the best plan at the best price. Make sure you fully understand these terms before signing anything.

- Premium – the dollar amount you pay to an insurance company for an insurance policy – premiums are usually paid on a monthly or yearly basis

- Deductible – the dollar amount you must pay out of pocket before your insurance company starts contributing

- Copay – the dollar amount you pay each time you need a specific medical service (copays generally do not contribute to your deductible)

- HMO vs. PPO – HMO and PPO are types of insurance plans – HMO stands for Health Maintenance Organization and PPO stands for Preferred Provider Organization

- Coinsurance – the percentage of the cost you pay after reaching your deductible

- HSA – HSA stands for Health Savings Account. It is essentially a tax-advantaged savings account dedicated to healthcare costs.

Blanket

Health insurance is an essential part of your financial plan. And the right health insurance policy is different for different families. Look at all of your options to see what makes sense for you and your family and your financial goals. Spend time on this decision and do some research if you need to. Remember that you will need to stick with your chosen plan for a full year.

What happens if I miss the open registration deadline?

If you do not enroll in health insurance during the normal enrollment period (from November 1, 2021 to January 15, 2022), you may not be able to enroll or switch health insurance plans before the enrollment period. membership the following year. Oh good? Yes really.

The only time you can make changes or register after the deadline is if you are experiencing a recent major event (marriage, birth, job loss, etc.). Such events trigger a Special Enrollment Period (SEP) where you can update your health insurance choices for the year.

But first you have to qualify. The health insurance industry calls these events qualifying life events. Let’s review the life changes that qualify for MS.

Loss of previous medical coverage

Losing your health insurance can be scary, but the good news is that any of the following events will qualify you for MS:

- To lose one’s job

- Be 26 years old

- Get canceled by a private carrier

- Loss of your eligibility for government-funded coverage

Move

Whether you are moving out of state or to another city within the same state, you may qualify for SEP if your move is permanent. If you have any questions, the U.S. Department of Health and Human Services (HHS) maintains updated guidelines on using a permanent move for SEP eligibility.

Marriage

Congratulation! Finding the love of your life is cause for celebration! Even better? You may qualify for an MS spouse so you can officially add your spouse to your health insurance.

Change of household

A happy family event such as childbirth or the adoption of a child entitles you to a SEP. More celebrations are in order! You can now add your new family member to your existing health insurance plan.

A not-so-happy event like a death or divorce can also trigger MS. But only if the event results in a loss of coverage.

Hourly

If you are enrolled in a Federal Marketplace healthcare plan, you have 60 days before and 60 days after the event to enroll or change your health insurance details.1 Once the 60 days have expired, the SEP is complete and you will need to submit an application for a new SEP.

If you are enrolled in a state-run plan, SEP scheduling requirements are managed by your individual state. If you are unsure of the SEP dates of your state-run exchange, check with your state market for details.

Employment-based healthcare plans have their own MS schedule requirements that are also different from the federal market. Companies must provide a SEP of at least 30 days.2

Our advice? No matter where your health plan comes from, don’t put off an MS claim. If you qualify for SEP, enroll or make changes to your plan as soon as possible. The longer you wait, the longer you’ll be without the health insurance you need, and the longer you risk financial disaster.

Questions to ask your employer

We’ve collected answers to the most common questions employees ask about employer-sponsored health plans. We can’t provide specific details about your employer’s health plan, but we can guide you to the questions you should ask to get the answers you need.

1. What are the enrollment and effective dates of the plan?

Most enrollment periods for company-sponsored health insurance plans are scheduled for November, and the effective date of the plan is usually January 1 of the following year. But companies have some leeway here. Be sure to ask your company’s plan administrator for specific enrollment/effective dates for your company.

2. How does the plan manage prescription drug costs?

Changes in drug coverage from Medicare providers happen all the time. Before you enroll or change your health insurance plan, check to see if your employer has added or excluded coverage that could affect the amount you pay for your prescriptions.

3. What is the cost to cover my spouse and children?

If you previously had coverage for a working spouse, ask your company’s plan administrator if they add or increase coverage for your spouse. Additionally, companies can make changes to employee contributions to cover dependent children. Find out about that too.

4. Can I go to the doctor and hospital of my choice?

Some employers switch health insurance companies, plans or provider networks to reduce costs. This may mean that your favorite doctors and hospitals may no longer be available on your plan. Ask your plan administrator about this so you can adjust if necessary.

5. Does this company do anything to help employees save money on healthcare costs?

Everyone is concerned about health care costs. Businesses too. In fact, some companies have made changes specifically designed to lower health care costs for their employees, including cutting out-of-pocket expenses, lowering premiums for low-wage workers, and some have even paid health care premiums. Employee Health Savings Accounts (HSAs). . Ask your company’s plan administrator if your employer has taken any such measures to help you save money.

Freelancer Open Registration FAQs

1. How do I know if I can register on the market as a freelancer?

You can register on the marketplace if you are a freelancer, consultant, or independent contractor who has no employees.

2. What should I know about COVID-related Open Enrollment?

Due to COVID, federal and some state markets have extended open registration this year. Federal Open Enrollment for 2021 coverage ended August 15, 2021. But some state markets will have registrations open until the end of the year. For 2022 coverage, open enrollment is November 1, 2021 through January 15, 2022.

3. Are there any registration exceptions if I missed the deadline?

Yes, if you qualify for a Special Enrollment Period (SEP), you can enroll in a health plan outside of normal enrollment dates. You will need to have experienced what the health insurance industry calls a qualifying life event. Qualifying life events can be things like marriage, birth, and moving.

4. What if I missed the open enrollment deadline and don’t have a qualifying life event?

No need to panic. You always have fallback options, including private health insurance companies and health care cost-sharing departments that might help you. We recommend connecting with one of our Approved Local Providers (ELPs) to learn more about your backup options.

- Get link

- X

- Other Apps

Comments

Post a Comment